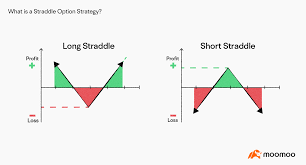

Moving beyond black scholes and onwards within a plethora of alternatives and derivatives, traders are endowed with enormous flexibility to latch onto market jinxes. Among many considerations, one of them is the options straddle that is a combination of buying or selling a call and put option on the same strike price and expiration date. This strategy has gained popularity among traders who indulge in intraday option trading for the possibility of earning due to market volatility.

Grasping the Function of the Straddle Strategy

The straddle strategy consists of trading a call option and a put option on the underlying asset with the same strike price and expiration date. The crux of its practice is to profit from enormous market movements, whatever the direction.

A long straddle has call and put options being bought. A short straddle has both options and derivatives sold. Each has its advantages and disadvantages, and it is, therefore, of utmost necessity for traders to know adequately when and how to use them.

Long Straddle: Betting on Volatility

Long straddle setups are for traders expecting wild price movement in the underlying asset. These setups benefit large market moves in either direction and tend to become popular around extremely important economic events, earnings releases, or periods of market indecision.

How It Works:

Buy a call option at a specific strike price.

Buy a put option at the same strike price.

Wait for markets to move significantly in one of the two directions.

Profit Potentials and Risks:

Profit: The larger the move, the greater the potential profit. The upside theoretically is unlimited once prices start to rise, whereas the downside profit potential is substantial once the price begins to tumble.

Risk: The maximum loss is limited to the premium paid for both options. If the underlying asset remains neutral, both options depreciate value because of time decay, causing losses.

Best Situations for Long Straddle:

High volatility expected.

Earnings announcements or economic data releases.

Uncertain market conditions with unpredictable swings.

Short Straddle: Profit from Stability

The short straddle strategy is used when traders think that the market will not move much. Instead of buying options, they sell a call option and a put option together at the same strike price so that the premium would be theirs as profit if the market stays within a range.

Main characteristic and components:

Sell a call option at a particular strike price.

Sell a put option at the same strike price.

Hold on until expiration of the position or exit before if needed.

Potential of Profit and Risk:

Profit: Maximum profit is capped at the premium collected from selling the options. In the event of the market staying steady and both options expiring worthless, the whole premium would be pocketed by the trader.

Risk: In theory, risk is limitless. Any major move against the position will carve serious holes in the trader’s pockets as they are liable to fulfill terms of the contract.

Best Short Straddle Scenarios:

Low volatility environmental surroundings.

Market outlook with firm support and resistance.

Consolidation periods with no big economic events in the calendar.

Long vs Short Straddle: Which One Is Better?

Both have their merits and demerits, and the ultimate choice rests with the trader’s outlook on the market and risk appetite.

When to Use Long Straddle:

If you expect extreme swings and do not know which way.

When a major event like an earnings report is due to hit the market and induce volatility.

For traders who carry out intra-day option trade and react to changes in price almost instantaneously.

When to Use Short Straddle:

If the expected movement is of limited range in the market.

If historical data point towards low volatility over the time frame.

For risk capital traders seeking consistent premiums.

Conclusion

The strategy of options straddle is an exceptional market tool for traders wanting to profit from volatility or stability. Long straddles would be suitable in the volatile market with high chances of producing profits during rapid moves while short straddles may be considered for the stable market where price action is range-bound. In both instances, risk management strategies such as stop losses and position sizing should be adopted to protect the capital.

Leave a Reply